| Home | Blog | Ask This | Showcase | Commentary | Comments | About Us | Contributors | Contact Us |

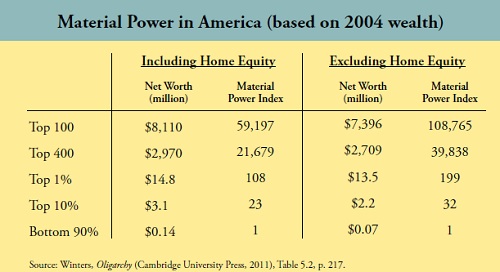

'Wealth defense industry' protects oligarchs from the rabble and its taxesCOMMENTARY | December 346, 2011Thousands of lawyers, accountants and consultants work full-time to defend the wealth of the richest Americans, says a Northwestern University political economist. It's their secretive labor that makes the effective tax rate so regressive for the ultra-rich -- and makes everyone else so angry By Dan Froomkin Occupy protesters are putting their bodies on the line day and night -- leaving their homes, living in tents, braving the elements, and being treated as criminals by the police. But the super-rich whose influence they are protesting have others to do their fighting for them. "Oligarchs can go about their business as literally thousands of fulltime professionals work for their interests," says Northwestern University political economist Jeffrey Winters, author of the 2011 book Oligarchy. Winters coined the term "wealth defense industry" to describe this veritable army that serves the super-rich, and in a recent article in the American Interest he explained that it "is comprised of lawyers, accountants, wealth management consultants, revolving-door lobbyists, think-tank debate framers and even key segments of the insurance industry whose sole purpose is income defense for America’s oligarchs. " It's "a multi-billion dollar industry per year, and it feeds completely on the need of wealthy people to defend their wealth," Winters says in an interview. The paramount goal is simple and specific: "To not pay taxes and to keep as much of their fortunes as they possibly can across generations." The means are extremely complicated and expensive, typically involving individually tailored, painstakingly crafted techniques -- or "structured tax products"-- based on arcane interpretations of the nation's 70,000-page tax code. Those schemes often involve moving money through offshore tax havens and anonymous shell corporations -- generally with the goal of sheltering the money and creating paper losses that can be applied to the client's tax bill. "The wealth defense industry arose as part of the demand on the part of wealthy people, but it's now taken on a life of its own and is proactive," Winters says. In the 1970s, oligarchs paid an average effective tax rate of about 55 percent, which was almost 80 percent of the top rate, Winters calculates. Over the years, the wealth defense industry lobbied relentlessly to cut the top tax rates -- while the ability of oligarchs to hide their money increased. So by 2007, their effective tax rate was down to 16.5 percent, or about half the top rate. "The result is that the tax rate on the wealthiest American is absolutely regressive," Winters says. And needless to say: "There is no equivalent to the wealth defense industry for average Americans -- or even the vast majority of the affluent." Most Americans are what Winters calls "Turbotaxpayers" -- they type in their financial information, the computer program reminds them of their deductions, and they file. "That's the extent of wealth defense for the average American." The current tax system, he says, "is only progressive up to the level of the mass affluent." (He considers households with annual incomes in the $500,000 to $3 million range to be the "mass affluent.") "Their incomes are actually too low for this industry to pay attention to them," he says. "Those people tend to pay their full tax bracket -- and they complain the most." "Every major law firm has a wealth-management or trusts section. There are whole firms that are wealth management firms that are wholly devoted to this." And the amount of money the industry saves its clients is staggering. Estimates of how much tax revenue is lost each year simply due to wealthy individuals using offshore tax schemes range as high as $70 billion. By comparison, the Bush tax cuts for those making over $250,000 cost the U.S. Treasury about $60 billion a year. "The Bush tax cuts are on the political radar screen; an equivalent amount is off the radar screen," Winters says. And, he notes: "Even if you put the Bush tax cuts back in place, those who use the wealth defense industry would never pay those rates." The nearly secret weapon of the wealth defense industry is what's known as a "tax opinion letter." "No taxpaying mortal has ever heard of a tax opinion letter. Most of us can't afford to buy one," Winters says. "The very cheapest one you can find will cost roughly $300,000 per letter" and that's a "downmarket" version. "The ordinary tax opinion letter costs closer to $3 million." A 2003 Senate report on KPMG's massive tax-shelter business explained: A tax opinion letter, sometimes called a legal opinion letter when issued by a law firm, is intended to provide written advice to a client on whether a particular tax product is permissible under the law and, if challenged by the IRS, how likely it would be that the challenged product would survive court scrutiny. "It gives you a very complex tax product, often a combination of trusts along with sheltering personal assets in foreign tax havens," Winters says. A frequent element is the establishment of " anonymous shell corporations that engage in transactions that are not actually real, rack up huge losses on paper, all of which is incredibly hard to follow." And here's the crux: "If you're challenged by the IRS, the law firm, as part of the tax opinion process, guarantees that it will back you." The undisguised message: "I not only have the resources to buy this tax instrument in the first place, but I have the resources to stare down the IRS if it gets challenged." Because IRS auditors are supposed to take "litigation risk" into consideration to avoid getting bogged down in costly and time-consuming lawsuits, this creates an incentive for them to look elsewhere. And if they do pursue a challenge, they have a big incentive to come to some kind of settlement -- negotiated by the same tax attorneys who wrote the original letter -- that doesn't involve any criminal charges. "The oligarchs get the tax savings initially; chance of getting challenged is low; chance of getting criminally charged is almost zero," Winters says. The gains the industry provides its clients have hugely contributed to income inequality, Winters says. In his article in the American Interest, he offers up what he calls a "Material Power Index" where the number one equals the average wealth position of Americans across the bottom 90 percent of the population.

Here's what the wealth defense industry has wrought: Measured by household wealth, he finds that "oligarchs at the very top of American society have an MPI just over 20,000, which happens to be twice the MPI of Roman senators relative to their society of slaves and landless farmers. If home equity is excluded, the MPI for the richest Americans doubles to 40,000 times an average member of the middle class.” What this means, Winters says, "is that although U.S. democracy is founded on one-person-one-vote, each oligarch can bring to the political table the dollar impact of 20,000 Americans. Decisions like Citizens United open the flood gate for oligarchs and their minions in the wealth defense industry to flex the maximum political muscle money can buy. And that's just in the context of electoral campaigns. No one is even talking about how the wealth defense industry silently and invisibly benefits American oligarchs every day, year-round." By contrast, he says: "Anybody who wants to challenge the wealthy, they've got to get rained on, and eventually snowed on, and it means they have to stop whatever they're doing. Ordinary citizens actually have to join organizations and physically be there and participate, to the exclusion of anything else they might do. And that is at tremendous burden." His conclusion: "This is one of the reasons a very small number of ultra-wealthy Americans can distort democracy in their favor against tens of millions of ordinary citizens."

|

|

||||||||||||