| Home | Blog | Ask This | Showcase | Commentary | Comments | About Us | Contributors | Contact Us |

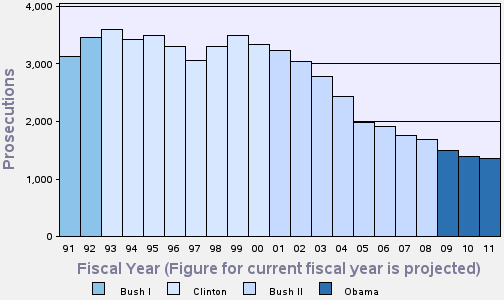

If you had to guess, would you say federal financial fraud prosecutions are up? Or down?ASK THIS | November 319, 2011The pervasive fraud at the heart of the financial crisis has not slowed the steady, 13-year decline in the federal prosecution of financial institution fraud, reports TRAC. What forces are at play here? A new report from the Transactional Records Access Clearinghouse (TRAC) finds that federal prosecutions for financial institution fraud are -- shockingly -- down year over year, as they have been every year since 1999. Pervasive fraud, at virtually every level of the mortgage and mortgage-securitization business, was at the heart of the financial crisis and the ensuing foreclosure catastrophe. (See, for instance: Nine stories the press is underreporting -- fraud, fraud and more fraud.)

But federal fraud prosecutions still continue to decline.

TRAC, a research center at Syracuse University that meticulously collects data about federal law enforcement, staffing and spending, found that during the first 11 months of the 2011 fiscal year, the government reported filing 1,251 new financial institution fraud prosecutions. At that pace, the report found, "the annual total of prosecutions will be 1,365 for this fiscal year, down 28.6 percent from their numbers of just five years ago and less than half the level prevalent a decade ago. "

The Nieman Watchdog Project asked TRAC co-director David Burnham what questions this data should raise for journalist. His suggestions:

Q. Over the years, the FBI has played a major federal role in white collar crime investigations. Have the FBI's growing responsibilities for investigating terrorism reduced the number of agents available to work on financial institutions fraud matters?

Q. Is the FBI's growing emphasis on terrorism and its declining interest on various kinds of white collar crime one of the hidden "costs" of 9/11?

Q. Are other agencies -- such as the IRS, SEC, etc -- picking up the slack?

Q. When it comes to measuring annual murder trends in the United States, the standard metric has long been the number of the bodies. Though not a perfect metric, it is a quite good way of determining the size of the problem on a year-by-year basis. News stories suggest a growth in financial institutions fraud. What is the value of this anecdotal information? Are there less anecdotal ways to track the trends? Does the steady decline in prosecutions mean that the problem is declining -- or that other forces are at work?

|

|||||||||||||